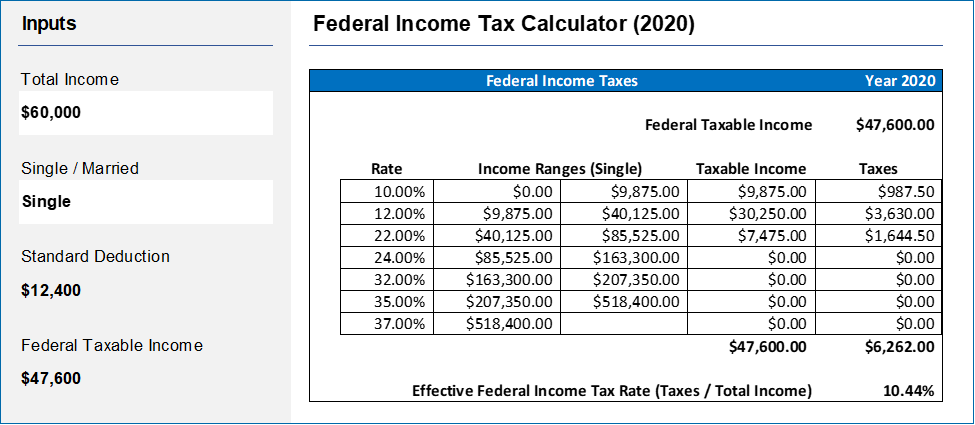

Irs tax calculator 2020

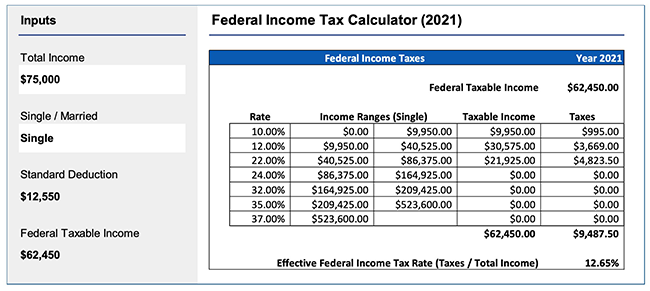

The calculator listed here are for Tax Year 2020 Tax Returns. Enter your filing status income deductions and credits and we will estimate your total taxes.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Our free tax calculator is a great way to learn about your tax situation and plan ahead.

. For more information see IRS Publication 501. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. It is mainly intended for residents of the US.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. IRS tax forms.

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. Include your income deductions and credits to calculate Client Login Create an. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Use the PriorTax 2020 tax calculator to find out your IRS tax refund or tax due amount. Sales Tax Deduction Calculator. Ad Always Free Always Simple Always Right.

Prepare File Prior Year Taxes to the IRS Fast. Businesses and Self Employed. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

2020 Simple Federal Tax Calculator. If the return is not complete by 531 a 99 fee for federal and 45 per state return. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS.

Based on your projected tax withholding for. Use your income filing status deductions credits to accurately estimate the taxes. In tax calculator.

File Now Get Your 2020 IRS Tax Refund Fast. And is based on the tax brackets of 2021 and. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Prior Year FederalState Tax Prep. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. 1 online tax filing solution for self-employed.

By using this site you agree to the use of cookies. Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020. The purpose of this calculator to give you an idea about.

Estimate your state and local sales tax deduction. US tax calculator is a web calculator for quickly finding the tax on your total income. Due to the coronavirus crisis and changes in the US federal tax code from the recently passed American Rescue Plan Act of.

Effective tax rate 172. COVID-19 the American Rescue Plan Act of 2021. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

Based on your projected tax withholding for the year we can also estimate.

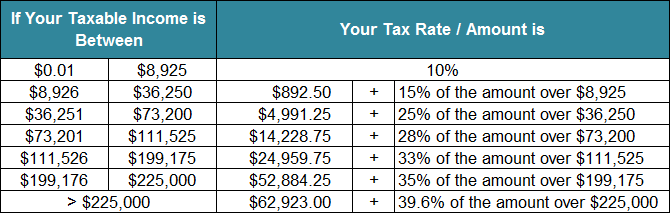

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Inkwiry Federal Income Tax Brackets

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Federal Calculator Calculator Federal Credit Union Hadleysocimi Com

2021 Estate Income Tax Calculator Rates

How To Calculate Federal Income Tax 11 Steps With Pictures

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Federal Income Tax

Federal Calculator Calculator Federal Credit Union Hadleysocimi Com

Paycheck Calculator Take Home Pay Calculator

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

2014 Federal Income Tax Forms Complete Sign Print Mail

Federal Calculator Calculator Federal Credit Union Hadleysocimi Com

Tax Calculator Estimate Your Income Tax For 2022 Free

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Inkwiry Federal Income Tax Brackets